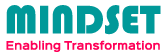

Ever since the industrial revolution, the manufacturing industry evolution has always been driven by new technologies that facilitate improvements such as increased throughput, lower costs and reduced downtime.

In modern times, the evolution is with the confluence of technologies integrating cyber-virtual and cyber-physical systems, culminating in I4.0. Cyber–physical systems (CPS) and Digital twins (DTs), the new paradigms of virtual-physical-cyber integration are the key enabling systems to manage transformation of product lifecycle reduction, product mass customization, and growth in product variety, reduction of time to market.

CPS and DTs share the same essential concepts of an intensive cyber–physical connection, real-time interaction, organization integration, and in-depth collaboration. Why then, do these two concepts exist in parallel, and why are they used in different fields? What are their respective core elements? And which is more suitable in practice? These are some of the moot questions, often heard in forums.

Different perceptions, some misconceptions and many unanswered questions has drawn me to deep dive and try uncover the differences and correlation between Cyber Physical Systems and Digital Twins.

CPS emphasize on sensors and actuators with the concept of system thinking, integrating computational and physical processes from networked products and operations. It defines how a physical system integrates sensor, communication, computing and control in a large scale cyber infrastructure to provide real-time sensing, information feedback and dynamic control for complex systems, making the mapping between the cyber and physical worlds one-to-many.

CPS are more foundational, as they do not directly have reference to implementation approaches or particular applications. Efficient collaboration between the cyber and physical worlds enable the functions of CPS.

DTs emphasize on models and data with the concept of using a digital copy of a physical system and provides a complete digital footprint of product. Using bi-directional dynamic mapping, the physical entities and virtual models co-evolve and have a similar appearance, like twins, and the same behaviors, like a mirror image. The mapping relationship between the physical and digital worlds helps provide a one-to-one correspondence to directly optimize the operations and adjust physical process through feedback.

Digital Twin system has multiple definitions and each has a different perspective. From product designer perspective, product life cycle management (PLM) is the key platform to use product design model to monitor, test, control, and service the products in the field. From a user perspective, user data from the usage is the key source to model the purpose (quality, efficiency, maintenance, etc.).

In Summary both CPS and DTs pave the way for smart manufacturing by forming a closed loop between the cyber/digital and physical worlds based on state sensing, real-time analysis, scientific decision-making, and precise execution. However, by virtue of its virtual models, a DT provides a more intuitive and effective means of improvement in engineering.

Through continuous data integration, the DTs’ capability of offering related solutions can be strengthened. Virtual models can be used as a supplement to enrich the composition and functions of CPS, so DT technology can be considered a necessary foundation for building CPS and for opening the way to the realization of CPS. The combination of CPS and DTs would help manufacturers achieve more precise, better, and more efficient management.